Overview in the Philippine REIT:

A Real Estate Investment Trust (REIT) is a publicly-listed stock company that owns income-generating real –estate assets, such as malls, offices, warehouses, hotels, and other infrastructures like power plants and toll roads. The income cascades down to investors in the form of dividends.

The Real Estate Investment Trust (REIT) Law or Republic Act No. 9856 or Philippine REIT Law was enacted in 2009 with the goal to promote economic development in capital markets, democratize the distribution of wealth by increasing Filipino participation in the Philippine real estate market, enable the financing of infrastructure and other projects through the management of capital markets, and provide protection to the investing public. Philippines REITs are required to disburse 90% of incomes as dividends.

In the overview of the 3rd APAC REIT Investment Summit 2019, it stated that the REIT market is an extremely lucrative investment product valued at about $68.33 billion in Asian capital markets and at $604 billion globally back in 2008, the time when the Philippine government was still having discussions on the passage and the plans for the REIT.

“The REIT industry across the world has continued growing since the passing of REIT law in the Philippines. In June 2014, the industry was estimated to be valued at about $140 billion in Asia and $1.4 trillion cumulatively in all parts of the word,” it added.

However, since the passing of the REIT Law in the Philippines, it has not made significant progress in attracting REIT listing s due to a couple of taxation hindrances.

Today, with the recent move of the Philippine government, specifically the Philippine Stock Exchange and the Securities and Exchange Commission (SEC) towards an investor-friendly rules on REIT to further the investment flows and help sustain growth in the Philippine capital markets, industry experts foresee a wave of REIT listing starting this year.

PH REIT developments to bolster REIT Listings

But are the real estate companies ready?

With all the opportunities REIT offers comes the challenge. One of the biggest setbacks the REIT-listed companies face involves the reporting--- since they have relatively higher level of risk compared to their private equity counterparts.

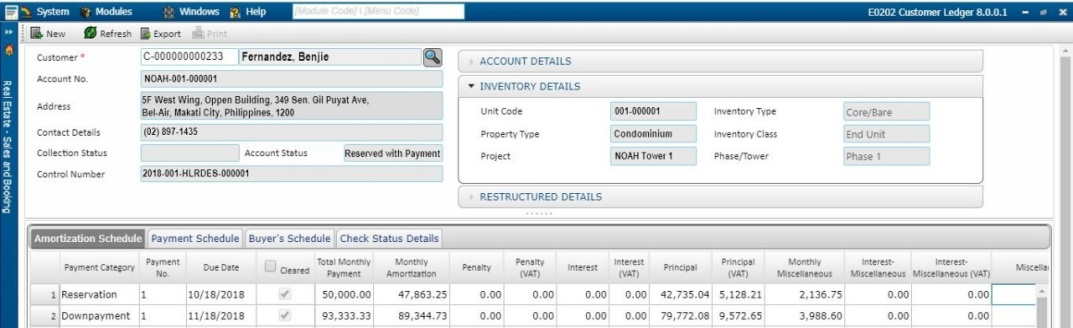

The NOAH Real Estate Management software meets all the requirements in the management and operations of REIT -listed companies. It can handle the challenges REIT-listed companies commonly face in terms of reporting, such as data accuracy and visibility with its automated financial system for real estate companies. NOAH Real Estate Management software has complete accessibility to create, generate, and publish financial statements, variance analysis, performance management reports and dashboards, and other statutory and management reports, REIT companies can ensure compliance with specific business and investment models.

With the technologies wide and seemingly unlimited scope, data security is a paramount concern. In terms of security, the NOAH Real Estate Management software provides holistic security parameters where the system user is ensured that all sensitive information is protected to prevent hacking incidences.

With NOAH Real Estate Management Software, you can adapt to the ever-evolving market shifts to drive significant outcomes in the real estate sector.

NOAH: Advancing the role of ERP